第五章 外汇交易基础¶

对的,上来就给你看技术指标,绝对没错!

5.1 技术指标¶

Bill Williams Indicators¶

Acceleration/Deceleration Oscillator(AC)¶

Acceleration/Deceleration (AC) technical indicator signals the acceleration or deceleration of the current market driving force.

How to Use Acceleration/Deceleration

The indicator is fluctuating around a median 0.00 (zero) level which corresponds to a relative balance of the market driving force with the acceleration. Positive values signal a growing bullish trend, while negative values may be qualified as a bearish trend development. The indicator changes its direction before any actual trend reversals take place in the market therefore it serves as an early warning sign of probable trend direction changes.

The indicator color changes alone are very important as the current green line (irrespectively of the value) warns against long positions the same way as the red one would against selling.

To enter the market along with its driving force one needs to watch for both value and color. Two consecutive green columns above the zero level would suggest you to enter the market with a long position while at least two red columns below the zero level might be taken for a command to go short.

Fake signals prevail in timeframes smaller than 4 hours.

Acceleration/Deceleration Oscillator Formula (Calculation)

AC bar chart is the difference between the value of 5/34 of the driving force bar chart and 5-period simple moving average, taken from that bar chart.

AO = SMA(median price, 5)-SMA(median price, 34)

AC = AO-SMA(AO, 5)

Alligator¶

Alligator is an indicator designed to signal a trend absence, formation and direction. Bill Williams saw the alligator's behavior as an allegory of the market's one: the resting phase is turning into the price-hunting as the alligator awakes so that to come back to sleep after the feeding is over. The longer the alligator is sleeping the hungrier it gets and the stronger the market move will be.

How to Use Alligator Indicator

The Alligator indicator consists of 13-, 8- and 5-period smoothed moving averages shifted into the future by 8, 5 and 3 bars respectively which are colored blue, red and green representing the alligator’s jaw, teeth and lips.

The Alligator is resting when the three averages are twisted together progressing in a narrow range. The more distant the averages become, the sooner the price move will happen.

The averages continuing in an upward direction (green followed by red and blue) suggest an emerging uptrend which we interpret as a signal to buy.

The averages following each other in the reversed order down the slope are a strong signal of an unfolding downtrend so selling at this point would be more than appropriate.

Alligator Indicator Formula (Calculation)

MEDIAN PRICE = (HIGH + LOW) / 2

ALLIGATORS JAW = SMMA (MEDEAN PRICE, 13, 8)

ALLIGATORS TEETH = SMMA (MEDEAN PRICE, 8, 5)

ALLIGATORS LIPS = SMMA (MEDEAN PRICE, 5, 3)

Awesome Oscillator(AO)¶

Awesome Oscillator (AO) is a momentum indicator reflecting the precise changes in the market driving force which helps to identify the trend’s strength up to the points of formation and reversal.

How to Use Awesome Oscillator

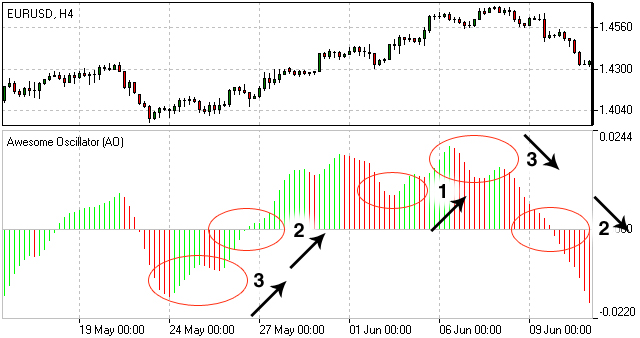

There are three main signals which may be seen:

- Saucer - three consecutive columns above the nought line the first two of which must be colored red (the second one is lower than the first one) while the third one is colored green and higher than the previous (second) one. Such a formation would be a clear Buy signal whilst inverted and vertically flipped formation would serve as a Sell signal.

- Nought line crossing - the histogram crosses the naught line in an upward direction changing its values from negative to that of positive ones. In this situation we have a Buy signal. The Sell signal would be a reversed pattern.

- Two pikes - the indicator displays a Buy signal when the figure is formed by two consecutive pikes both of which are below the naught line and the later-formed pike is closer to the zero level than the earlier-formed one. The Sell signal would be given by the reverse formation.

Awesome Oscillator Trading Strategy

Awesome Oscillator Strategy includes 3 ways of trading. The first way is to open a sell position when the oscillator is below the zero line forming a peak, and open a buy position when the oscillator is above the zero line forming a gap.

Another way is to open a sell position when the oscillator forms two peaks above the zero line, where the second high is lower than the previous one. And, conversely, traders watch to open a buy position when the oscillator forms to lows below the zero line with the last one not as low as the previous one.

The third way is to account crossing the zero line. When the oscillator crosses it from up to down, it is time to open a sell position and when it crosses from down to up, it is time to open a buy position.

Awesome Oscillator Formula (Calculation)

Awesome Oscillator is a 34-period simple moving average, plotted through the central points of the bars (H+L)/2, and subtracted from the 5-period simple moving average, graphed across the central points of the bars (H+L)/2.

MEDIAN PRICE = (HIGH+LOW)/2

AO = SMA(MEDIAN PRICE, 5)-SMA(MEDIAN PRICE, 34)

where

SMA — Simple Moving Average.

Fractals¶

Fractals is an indicator highlighting the chart’s local heights and lows where the price movement had stopped and reversed. These reversal points are called respectively Highs and Lows.

How to Use Fractal Indicator

Bill Williams' Fractals are formed around a group of five consecutive bars the first two of which are successively reaching higher (or diving deeper) and the last two descending lower (or growing higher) with the middle one being the highest (or the lowest) result in the group accordingly.

Buy fractal is an arrow pointing to the top

Sell fractal is an arrow pointing to the bottom

Gator Oscillator(GO)¶

The Gator Oscillator (GO) is a supplement to the Alligator indicator and is used alongside with it showing the absolute degree of convergence/divergence of the Alligator's three SMAs pointing at the Alligator's periods of slumber and awakeness (i.e. trending and non-trending market phases).

How to Use Gator Oscillator

Being an oscillator in the form of two histograms built on either side of the naught line, the Gator Oscillator plots the absolute difference between the Alligator’s Jaw and Teeth (blue and red lines) in the positive area and the absolute difference between the Alligator’s Teeth and Lips (red and green lines) in the negative area. The histogram’s bars are colored green if exceeding the previous bar’s volume or red if falling short.

The bars of the extreme values are in tune with the strong trend forces.

The Alligator's activity periods are divided into the following four:

- Gator awakes - the bars on different sides of the naught line are colored differently.

- Gator eats - green bars on both sides of the naught line.

- Gator fills out - single red bar during the "eating" phase.

- Gator sleeps - the bars on both sides are red

.jpg)

Market Facilitation Index¶

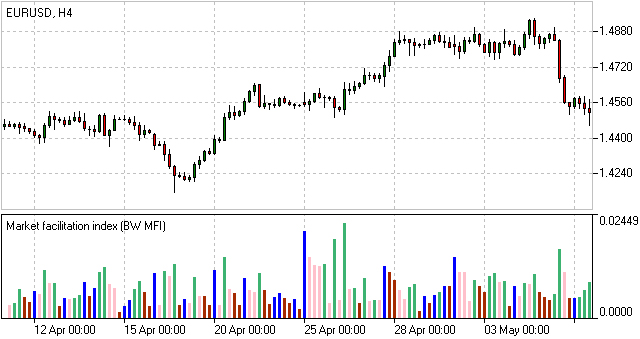

The Market Facilitation Index is designed for evaluation the willingness of the market to move the price. The indicator's absolute values alone cannot provide any trading signals unlike it's dynamics in relation to the dynamics of the volume.

How to Use Market Facilitation Index

The absolute values of the index are represented by the histogram's bars while the comparison of the index and volume dynamics are given in colors which are vital in terms of reading the indicator signs.

Green bar - both MFI and volume are up. Increasing trading activity means market movement acceleration. We may join the trend.

Blue bar - MFI indicator is up, volume is down. The movement is continuing although the volume has dropped. The trend will soon be reversing.

Pink bar - MFI indicator is down, volume is up. The slowing down movement while volume is raising may indicate a possible break through, often a U-turn.

Brown bar - both MFI and volume are down. The market is no longer interested in the current direction and is looking for signs of a future development.

Market Facilitation Index Formula (Calculation)

BW MFI = (HIGH-LOW)/VOLUME

Oscillator¶

Aroon¶

Developed by Tushar Chande in 1995, Aroon is an indicator system that determines whether a stock is trending or not and how strong the trend is. “Aroon” means “Dawn's Early Light” in Sanskrit. Chande chose this name because the indicators are designed to reveal the beginning of a new trend. The Aroon indicators measure the number of periods since price recorded an x-day high or low. There are two separate indicators: Aroon-Up and Aroon-Down. A 25-day Aroon-Up measures the number of days since a 25-day high. A 25-day Aroon-Down measures the number of days since a 25-day low. In this sense, the Aroon indicators are quite different from typical momentum oscillators, which focus on price relative to time. Aroon is unique because it focuses on time relative to price. Chartists can use the Aroon indicators to spot emerging trends, identify consolidations, define correction periods and anticipate reversals.

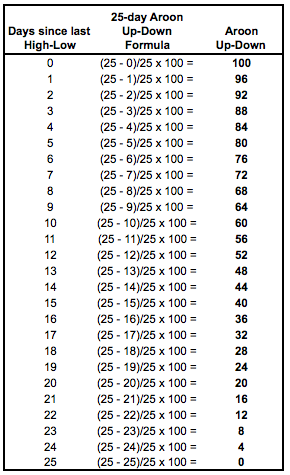

Calculation

The Aroon indicators are shown in percentage terms and fluctuate between 0 and 100. Aroon-Up is based on price highs, while Aroon-Down is based on price lows. These two indicators are plotted side-by-side for easy comparison. The default parameter setting in SharpCharts is 25 and the example below is based on 25 days.

Aroon-Up = ((25 - Days Since 25-day High)/25) x 100

Aroon-Down = ((25 - Days Since 25-day Low)/25) x 100

Aroon declines as the elapsed time between a new high or low increases. 50 is the cut off point. Because 12.5 days marks the exact middle, a reading of exactly 50 is impossible on a daily chart. It is possible with other timeframes. On daily charts, Aroon is either below 50 (48) or above 50 (52). A reading above 50 means a new high or low was recorded within the last 12 days or less. This is the most recent half of the look-back period. A reading below 50 means a new high or low was recorded within the last 13 days or more {(25-13)/25 x 100 = 48). This is the latter half of the look-back period. The table below shows the range of values for 25-day Aroon-Up and 25-day Aroon-Down

Interpretation

The Aroon indicators fluctuate above/below a centerline (50) and are bound between 0 and 100. These three levels are important for interpretation. At its most basic, the bulls have the edge when Aroon-Up is above 50 and Aroon-Down is below 50. This indicates a greater propensity for new x-day highs than lows. The converse is true for a downtrend. The bears have the edge when Aroon-Up is below 50 and Aroon-Down is above 50.

A surge to 100 indicates that a trend may be emerging. This can be confirmed with a decline in the other Aroon indicator. For example, a move to 100 in Aroon-Up combined with a decline below 30 in Aroon-Down shows upside strength. Consistently high readings mean prices are regularly hitting new highs or new lows for the specified period. Prices are moving consistently higher when Aroon-Up remains in the 70-100 range for an extended period. Conversely, consistently low readings indicate that prices are seldom hitting new highs or lows. Prices are NOT moving lower when Aroon-Down remains in the 0-30 range for an extended period. This does not mean prices are moving higher though. For that we need to check Aroon-Up.

New Trend Emerging

There are three stages to an emerging trend signal. First, the Aroon lines will cross. Second, the Aroon lines will cross above/below 50. Third, one of the Aroon lines will reach 100. For example, the first stage of an uptrend signal is when Aroon-Up moves above Aroon-Down. This shows new highs becoming more recent than new lows. Keep in mind that Aroon measures the time elapsed, not the price. The second stage is when Aroon-Up moves above 50 and Aroon-Down moves below 50. The third stage is when Aroon-Up reaches 100 and Aroon-Down remains at relatively low levels. The first and second stages do not always occur in that order. Sometimes Aroon-Up will break above 50 and then above Aroon-Down. Reverse engineering the uptrend stages will give you the emerging downtrend signal. Aroon-Down breaks above Aroon-Up, breaks above 50 and reaches 100.

The chart above shows CSX Corp (CSX) with weekly bars and 25-week Aroon. First, notice that the downtrend began weakening as Aroon-Down declined below 50 at the end of 2007 (far left). The first stage of an uptrend was signaled when Aroon-Up moved above Aroon-Down in early 2008 (first orange circle). Aroon-Up continued above 50 and hit 100 as Aroon-Down remained at relatively low levels. Notice how Aroon-Up remained near 100 as the advance continued. This emerging uptrend signal lasted until September 2008 when Aroon-Down broke above Aroon-Up, exceeded 50 and surged to 100 (second orange circle). Notice how Aroon-Down remained near 100 as the downtrend extended. The third trend on this chart was signaled when Aroon-Up surged to 100 in June 2009 and remained above 50 for over a year (third orange circle). Also notice that Aroon-Down remained below 50 for over a year.

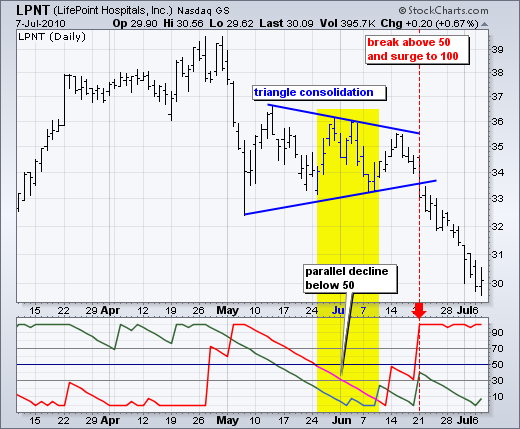

Consolidation Period

The Aroon indicators signal a consolidation when both are below 50 and/or both are moving lower with parallel lines. It makes sense that consistent readings below 50 are indicative of flat trading. For 25-day Aroon, readings below 50 mean a 25-day high or low has not been recorded in 13 or more days. Prices are clearly flat when not recording new highs or new lows. Similarly, a consolidation is usually forming when both Aroon-Up and Aroon-Down move lower in parallel fashion and the distance between the two lines is quite small. This narrow parallel decline indicates that some sort of trading range is forming. The first Aroon indicator to break above 50 and hit 100 will trigger the next signal.

The chart above shows Omnicom (OMC) with the Aroon indicators moving below 50 in a parallel decline. The width of the channel could be narrower, but we can see the consolidation taking shape on the price chart for confirmation. Both Aroon-Up and Aroon-Down were below 50 in the yellow area. Aroon-Up then broke out and surged to 100, which was before the breakout. Further confirmation came with another Aroon-Up surge at the breakout point. This surge/breakout signaled the end of the consolidation and the beginning of the advance.

The next chart shows Lifepoint Hospitals (LPNT) with 25-day Aroon. Both lines moved lower in May with a parallel decline. The distance between the lines was around 25 points throughout the decline. Aroon-Up and Aroon-Down flattened in June and both remained below 50 for around two weeks as the triangle consolidation extended. Aroon-Down (red) was the first to make its move with a break above 50 just before the triangle break on the price chart. Aroon-Down hit 100 as prices broke triangle support to signal a continuation lower.

Conclusions

Aroon-Up and Aroon-Down are complementary indicators that measure the elapsed time between new x-day highs and lows, respectively. They are shown together so chartists can easily identify the stronger of the two and determine the trend bias. A surge in Aroon-Up combined with a decline in Aroon-Down signals the emergence of an uptrend. Conversely, a surge in Aroon-Down combined with a decline in Aroon-Up signals the start of a downtrend. A consolidation is present when both move lower in parallel fashion or when both remain at low levels (below 30). Chartists can use the Aroon indicators to determine if a security is trending or trading flat and then use other indicators to generate appropriate signals. For example, chartists might use a momentum oscillator to identify oversold levels when 25-week Aroon indicates that the long-term trend is up.

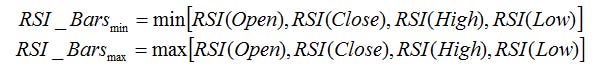

RSI Bar¶

RSI-Bars is an oscillator, developed by IFC Markets in 2014 as the modification of Relative Strength Index (RSI). RSI-Bars characterizes a stability of a price momentum and allows a definition of a trend potential. A distinctive feature of RSI-Bars is that this indicator takes into account the volatility of a considered instrument within the selected timeframe - values of RSI-Bars are defined with account of price OPEN/HIGH/LOW/CLOSE (OHLC) values and are displayed in the form of chart bars. This allows avoiding of false breakdowns of oscillator trend lines and that’s why traders may use methods of a chart analysis more efficiently in this case.

Download RSI-Bars for Metatrader 4

Installation guide:

Download and extract the zip archive with indicator file .ex4;

Open the data directory from the main menu of Metatrader 4 terminal:File =>Open Data Folder;

Put an indicator file into the folder MQL4/Indicators of Data Folder;

Restart the Metatrader 4 terminal;

In order to insert an indicator, open the group of custom indicators in the main menu: Insert=>Indicators=>Custom indicator.

Advantages of RSI-Bars oscillator

In contrast to the classical Relative Strength Index, developed by J.Wilder, RSI-Bars evaluates an internal volatility. Minimal and maximum limits of bars are constructed on the basis of 4 prices (OHLC). A calculated set is used for the selection of a minimum and maximum value of RSI-Bars. Then a bar structure is formed.

An analysis of a candlestick price chart in some cases allows avoiding of a trend false breakdowns. It happens due to the account of additional price information and it internal volatility. At the same way RSI-Bars takes into account a true range of price oscillations, not only a characteristic value of a given timeframe. Due to this property, RSI-Bars allows a correct and convenient use of a chart technical analysis.

A comparative analysis of RSI and RSI-Bars is represented on the figure below – we used H4 candlesticks of a most volatile pair, GBP/USD. As it can be seen, RSI(14) has shown and additional breakdown in contrast with RSI-Bars (14). Moreover, RSI-Bars has detected later and therefore more correct finishing of a downtrend.

The use of RSI-Bars is demonstrated in trade examples of everyday analytics releases of IFC Markets.

Application

The oscillator works most efficiently in a flat motion. A lower and higher bounds of oscillator values are introduced subjectively (for example 30% and 70%) and correspond to overbought and oversold levels;

- RSI-Bars can take extreme values during a trend motion. That’s why in this case a use of overbought and oversold levels is incorrect;

- RSI-Bars allows a definition of standard chart analysis instruments - figures, lines of support and resistance, etc. In this case the indicator should be used for a confirmation of technical analysis. We should take into account that RSI-Bars can give preliminary signals of a trend change;

- Divergence is the strongest signal of RSI-Bars – opposite directions of price and oscillator movements are detected in this case. This signal is a harbinger of a possible trend weakening;

- Values of RSI-Bars lie between 0% and 100%.

Average True Range(ATR)¶

The Average True Range (ATR) indicator was introduced by Welles Wilder as a tool to measure the market volatility and volatility alone leaving aside attempts to indicate the direction. Unlike the True Range, the ATR also includes volatility of gaps and limit moves. ATR indicator is good at valuating the market's interest in the price moves for strong moves and break-outs are normally accompanied by large ranges.

How to Use ATR Indicator

The ATR is used with 14 periods with daily and longer timeframes and reflects the volatility values that are in relation to the trading instrument's price. Low ATR values would normally correspond to a range trading while high values may indicate a trend breakout or breakdown. Average True Range Indicator

Average True Range Formula (ATR Calculation)

Average True Range is a moving average of the True Range which is the greatest of the following three values:

- The distance from today's high to today's low.

- The distance from yesterday's close to today's high.

- The distance from yesterday's close to today's low.

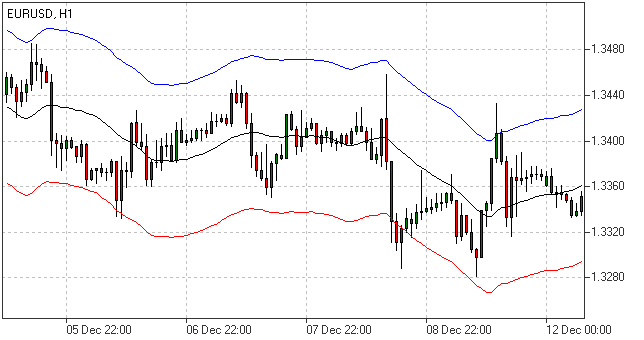

Bollinger Bands¶

The Bollinger Bands indicator (named after its inventor) displays the current market volatility changes, confirms the direction, warns of a possible continuation or break-out of the trend, periods of consolidation, increasing volatility for break-outs as well as pinpoints local highs and lows.

How to Use Bollinger Bands

The indicator consists of the three moving averages:

- Upper band - 20-day simple moving average (SMA) plus double standard price deviation.

- Middle band - 20-day SMA.

- Lower band - 20-day SMA minus double standard price deviation.

The increasing distance between the upper and the lower bands while volatility is growing, suggests of a price developing in a trend which direction correlates with the direction of the Middle line. In contrast to the above, at times of decreasing volatility when the bands are closing in, we should be expecting the price to move sidewards in a range.

The price moving outside the Bands may indicate either the trend’s continuation (when the bands are floating apart as the volatility increases) or the U-turn of the trend if the initial movement is exhausted. Either way each of the scenarios must be confirmed by other indicators such as RSI, ADX or MACD. Anyhow the price crossing of the Middle line from below or above may be interpreted as a signal to buy or to sell respectively.

Bollinger Bands Trading Strategy

Bollinger Bands trading strategy aims to profit from oversold or overbought conditions on the market. Prices are considered overextended on the upside when they touch the upper band (overbought). They are overextended on the downside, when they touch the lower band (oversold). This strategy is used as an immediate signal to buy or sell the security. The usage of upper and lower bands as price targets is referred to as the simplest way of using Bollinger Bands strategy. If prices cross below the average, the lower band becomes the lower price target. If the prices cross above the same average, the upper band identifies the upper price target.

In a Bollinger Band trading system an uptrend is shown by prices fluctuating between upper and middle bands. In such cases if prices cross below the middle band, this warns of a trend reversal to the downside indicating a sell signal.

In a downtrend, prices fluctuate between middle and lower bands, and the price crossing above the middle band warns of a trend reversal to the upside, indicating a buy signal.

Bollinger Bands Formula (Calculation)

The middle line (ML) is a regular Moving Average:

ML = SUM [CLOSE, N]/N

The top line (TL) is ML a deviation (D) higher:

TL = ML + (D*StdDev)

The bottom line (BL) is ML a deviation (D) lower.

BL = ML — (D*StdDev)

Where:

N — number of periods used in calculation;

SMA — Simple Moving Average;

StdDev — Standard Deviation.

Commodity Channel Index(CCI)¶

The Commodity Channel Index is an indicator by Donald Lambert. Despite the original purpose to identify new trends, it’s nowadays widely used to measure the current price levels in relation to the average one.

How to Use CCI Indicator

Commodity Channel Index indicator oscillates around the naught line tending to stay within the range from -100 to +100. The naught line represents the level of an average balanced price. The higher the indicator surges above the naught line the more overvalued the security is. The further the CCI indicator plunges into the negative area the more potential for growth the price may have.

Still the unbalanced price alone may not serve as a clear indicator neither to the direction the price is following nor to its strength. There are critical values and the crossing directions which need to be looked at closely:

- Exceeding past the 100 level suggests a possible further upward movement

- Decreasing past the 100 level indicates a U-turn and serves as a signal to sell.

- Decreasing past the -100 level suggests a possible further downward movement

- Exceeding past the -100 level indicates a U-turn and serves as a signal to buy.

- Crossing the naught line upwards from below serves as a confirmation to buy

- Crossing the naught line downwards from above serves a confirmation to sell.

Smaller CCI indicator period increases its sensitivity. Shifting critical levels to 200 allows to exclude insignificant price fluctuations.

CCI Trading Strategy

CCI trading strategy is used by most traders, investors and chartists as an overbought or oversold oscillator. The basic strategy of CCI is to watch the readings above +100 and below -100. The readings above +100 are considered overbought and generate buy signals. The readings below -100 are considered oversold and generate sell signals. Though the Commodity Channel Index was initially developed for commodities, it is also used for trading stock index futures and options.

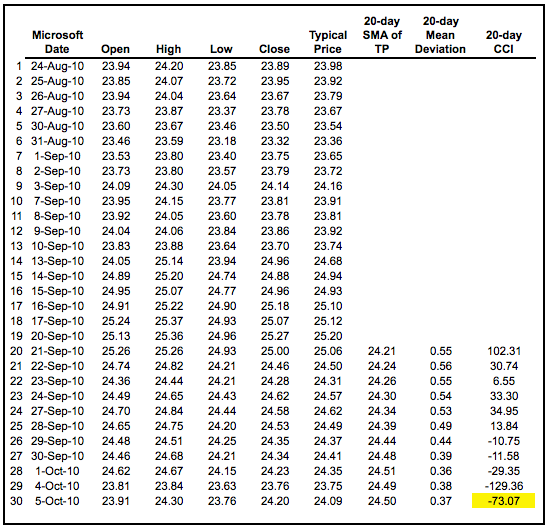

Caculation

The example below is based on a 20-period Commodity Channel Index (CCI) calculation. The number of CCI periods is also used for the calculations of the simple moving average and Mean Deviation.

CCI = (Typical Price - 20-period SMA of TP) / (.015 x Mean Deviation)

Typical Price (TP) = (High + Low + Close)/3

Constant = .015

There are four steps to calculating the Mean Deviation. First, subtract the most recent 20-period average of the typical price from each period's typical price. Second, take the absolute values of these numbers. Third, sum the absolute values. Fourth, divide by the total number of periods (20).

Lambert set the constant at .015 to ensure that approximately 70 to 80 percent of CCI values would fall between -100 and +100. This percentage also depends on the look-back period. A shorter CCI (10 periods) will be more volatile with a smaller percentage of values between +100 and -100. Conversely, a longer CCI (40 periods) will have a higher percentage of values between +100 and -100.

DeMarker(DeM)¶

This indicator was introduced by Tom DeMark as a tool to identify emerging buying and selling opportunities. It demonstrates the price depletion phases which usually correspond with the price highs and bottoms.

The DeMarker indicator proved to be efficient at identifying trend break-downs as well as spotting intra-day entry and exit points.

How to Use DeMarker Indicator

The indicator fluctuates with a range between 0 to 1 and is indicative of lower volatility and a possible price drop when reading 0.7 and higher, and signals a possible price increase when reading below 0.3.

DeMarker Indicator Formula (Calculation)

The DeMarker indicator is the sum of all price increment values recorded during the "i" period divided by the price minima:

The DeMax(i) is calculated:

If high(i) > high(i-1) , then DeMax(i) = high(i)-high(i-1), otherwise DeMax(i) = 0

The DeMin(i) is calculated:

If low(i) < low(i-1), then DeMin(i) = low(i-1)-low(i), otherwise DeMin(i) = 0

The value of the DeMarker is calculated as:

DMark(i) = SMA(DeMax, N)/(SMA(DeMax, N)+SMA(DeMin, N))

Envelopes¶

The Envelopes indicator reflects the price overbought and oversold conditions helping to identify the entry or exit points as well as possible trend break-downs.

How to Use Envelopes Indicator

The Envelopes indicator consists of two SMAs that together form a flexible channel in which the price evolves. The averages are plotted around a Moving Average in a constant percentage distance which may be adjusted according to the current market volatility. Each line serves as a margin of the price fluctuation range.

In a trending market take only oversold signals in an uptrend conditions and overbought signals in a downtrend conditions.

In a ranging market the price reaching the top line serves as a sell signal, while the price at the lower line generates a signal to buy.

Envelopes Indicator Formula (Calculation)

Upper Band = SMA(CLOSE, N)*[1+K/1000]

Lower Band = SMA(CLOSE, N)*[1-K/1000]

Where:

SMA — Simple Moving Average;

N — averaging period;

K/1000 — the value of shifting from the average (measured in basis points).

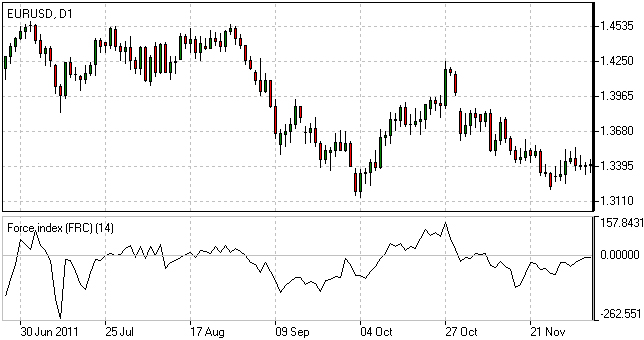

Force Index¶

The Force Index indicator invented by Alexander Elder measures the power behind every price move based on their three essential elements, e.g., direction, extent and volume. The oscillator fluctuates around the zero, i.e., a point of a relative balance between power shifts.

How to Use Force Index

The Force Index allows to identify the reinforcement of different time scale trends:

- The indicator should be made more sensitive by decreasing its period for short trends.

- The indicator should be smoothed by increasing its period for longer trends.

The Force Index may strongly imply a trend change:

- Break-down of an uptrend when the indicator's value is changing from positive to negative and price and indicator show divergence.

- Break-down of a downtrend when the indicator's value is changing from negative to positive and price and indicator show convergence.

Together with a trend-following indicator the Force Index can help identify trend corrections:

- An uptrend correction when the indicator bounces off the low.

- A downtrend correction when the indicator slides from a pike.

Force Index Formula (Calculation)

Force Index(1) = {Close (current period) - Close (prior period)} x Volume

Force Index(13) = 13-period EMA of Force Index(1)

Ichimoku¶

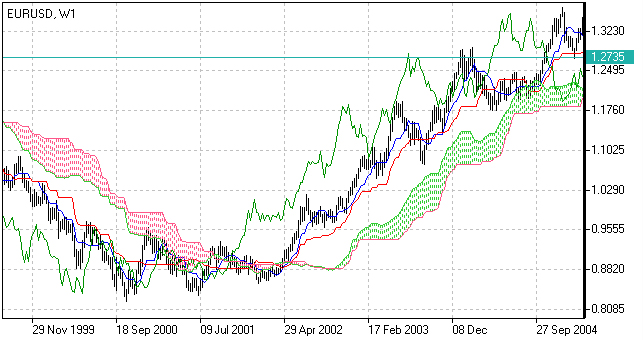

The Ichimoku Kinko Hyo (Equilibrium chart at a glance) is a comprehensive technical analysis tool introduced in 1968 by Tokyo columnist Goichi Hosoda. The concept of the system was to provide an immediate vision of trend sentiment, momentum and strength at a glance perceiving all the Ichimoku's five components and a price in terms of interactions among them of a cyclical type related to that of human group dynamics.

How to Use Ichimoku Indicator

The Ichimoku indicator consists of five lines which may all serve as flexible support or resistance lines, whose crossovers may as well be assumed as additional signals:

- Tenkan-Sen (Conversion line, blue)

- Kijun-Sen (Base line, red)

- Senkou Span A (Leading span A, green boundary of the cloud)

- Senkou Span B (Leading span B, red boundary of the cloud)

- Chikou Span (Lagging span, green)

Kumo (Cloud) is a central element of the Ichimoku system and represents support or resistance areas. It is formed by Leading Span A and Leading Span B.

Determining the trend persistence and corrections:

- Price moving above the cloud indicates an uptrend

- Price moving below the cloud indicates a downtrend

- Price moving within the cloud indicates a sideways trend

- Cloud turning from green to red indicates a correction during an uptrend

- Cloud turning from red to green indicates a correction during a downtrend

Determining support and resistance:

- Leading span A serves as a first support line for an uptrend

- Leading span B serves as a second support line for an uptrend

- Leading span A serves as a first resistance line for a downtrend

- Leading span B serves as a second resistance line for a downtrend

Strong Buy/Sell signals occurring above the cloud:

- Conversion line crosses Base line up from below is a signal to buy

- Conversion line crosses Base line down from above is a signal to sell

Less reliable Buy/Sell signals occurring within the cloud:

- Conversion line crosses Base line up from below is a signal to buy

- Conversion line crosses Base line down from above is a signal to sell

Ichimoku Trading Strategy

Traders use the Ichimoku strategy to identify the trend. For a bullish signal this trading strategy sets three criteria. First, the trend is bullish when prices reach above the lowest line of the cloud. Second, a bullish signal triggers when prices reverse and reach above the Conversion Line. And third, the trend is bullish when the price moves below the Base Line.

Ichimoku Formula (Ichimoku Kinko Hyo Calculation)

Tenkan-Sen (Conversion line, blue) is

(9-period high + 9-period low)/2

Kijun-Sen (Base line, red) is

(26-period high + 26-period low)/2

Senkou Span A (Leading span A, green boundary of the cloud) is

(Conversion Line + Base Line)/2

Senkou Span B (Leading span B, red boundary of the cloud) is

(52-period high + 52-period low)/2

Chikou Span (Lagging span, green) is

close price plotted 26 periods in the past

MACD¶

Moving-Average Convergence/Divergence Oscillator, commonly referred to as MACD indicator, is developed by Gerald Appel which is designed to reveal changes in the direction and strength of the trend by combining signals from three time series of moving average curves.

How to Use MACD Indicator

Three main signals generated by the MACD indicator (blue line) are crossovers with the signal line (red line), with the x-axis and divergence patterns.

Crossovers with the signal line:

- If the MACD line is rising faster than the Signal line and crosses it from below, the signal is interpreted as bullish and suggests acceleration of price growth;

- If the MACD line is falling faster than the Signal line and crosses it from above, the signal is interpreted as bearish and suggests extension of price losses;

Crossovers with the x-axis:

- A bullish signal appears if the MACD line climbs above zero;

- A bearish signal presents if the MACD line falls below zero.

Convergence/Divergence:

- If the MACD line is trending in the same direction as the price, the pattern is known as convergence, which confirms the price move;

- If they move in opposite directions, the pattern is divergence. For example, if the price reaches a new high, but the indicator does not, this may be a sign of further weakness.

MACD Indicator Formula (MACD Calculation)

MACD line = 12-period EMA – 26-period EMA

Signal line = 9-period EMA

Histogram = MACD line – Signal line

Momentum¶

Momentum Oscillator is an indicator that shows trend direction and measures how quickly the price is changing by comparing current and past prices.

How to Use Momentum Indicator

The indicator is represented by a line, which oscillates around 100. Being an oscillator, momentum should be used within price trend analysis.

Crossing the x-axis:

- It is believed that if the indicator climbs above 100 during an uptrend, it is a bullish signal;

- Otherwise if the indicator falls below 100 during a downtrend, a bearish signal appears.

Falling out of its normal range:

- Extreme points mean that the price has posted its strongest gain or loss for a particular number of moving periods, supporting trend strength;

- At the same time if the price movement was too rapid, they may indicate possible overbought and oversold areas.

Divergence patterns:

- If the price hits a new high, but the indicator does not, that could mean that investor sentiment is actually lower;

- And on the contrary if the price falls to a new low, but the indicator does not support the drop, it is a signal that the trend may end soon.

Momentum Indicator Formula (Calculation)

Momentum = (Current close price / Lagged close price) x 100

Relative Vigor Index(RVI)¶

Relative Vigor Index, developed by John Ehlers, is a technical indicator designed to determine price trend direction. The underlying logic is based on the assumption that close prices tend to be higher than open prices in a bullish environment and lower in a bearish environment.

How to Use RVI Indicator

The Relative Vigor Index allows to identify the reinforcement of price changes (and therefore may be used within convergence/divergence patterns analysis):

- Generally the higher the indicator climbs, the stronger is the current relative price increase;

- Generally the lower the indicator falls, the stronger is the current relative price drop.

Together with its signal line (Red), a 4-period moving average of RVI, the indicator (Green) may help to identify changes in prevailing price developments:

- Crossing the signal line from above, the RVI signals a possible sell opportunity;

- Crossing the signal line from below, the RVI signals a possible buy opportunity.

Relative Vigor Index Formula (RVI Calculation)

Relative Vigor Index (1) = (Close - Open) / (High - Low)

Relative Vigor Index (10) = 10-period SMA of Relative Vigor Index (1)

Relative Strenth Index(RSI)¶

Relative Strength Index is an indicator developed by Welles Wilder to assess the strength or the weakness of the current price movements and to measure the velocity of price changes by comparing price increases with its losses over a certain period.

How to Use RSI Indicator

The Relative Strength Index allows to identify possible overbought and oversold areas, but should be considered within trend analysis:

- Generally if the RSI indicator climbs above 70, the asset may be overbought;

- If the RSI indicator drops below 30, the asset may be oversold.

Leaving extreme areas the indicator may suggest possible corrections or even trend changes:

- Crossing the overbought boundary from above, the RSI signals a possible sell opportunity;

- Crossing the oversold boundary from below, the RSI signals a possible buy opportunity.

Convergence/divergence patterns may indicate possible trend weakness:

- If the price climbs to a new high, but the indicator does not, that may be a sign of the uptrend weakness;

- If the price falls to a new low, but the indicator does not, that may be a sign of the downtrend weakness.

RSI Trading Strategy

RSI trading strategy aims to generate buy and sell signals by the horizontal lines that appear on the chart at the 70 and 30 values. As we have already mentioned above, a move under 30 indicates an oversold condition and a move above 70 signals an overbought condition.

Thus, if a trader is looking for a buying opportunity, he watches the indicator dip under 30. A crossing back above 30 is considered by many traders as a confirmation that the trend has turned up. Conversely, if a trader seeks for a selling opportunity, he watches the indicator cross above the 70 line.

Relative Strength Index Formula (RSI Calculation)

RSI = 100 – 100/(1 + RS)

RS (14) = Σ(Upward movements)/Σ(|Downward movements|)

Stochastic¶

Stochastic indicator is introduced by George Lane to identify price trend direction and possible reversal points by determining the place of the current close price in the most recent price range, as in a sustainable uptrend close prices tend to the higher end of the range and to the lower end in a downtrend.

How to Use Stochastic Oscillator

The Stochastic oscillator allows to identify possible overbought and oversold areas, but should be considered within trend analysis:

- Generally if the indicator climbs above 75, the asset may be overbought;

- If the indicator drops below 25, the asset may be oversold.

Leaving extreme areas the indicator may suggest possible turning points:

- Crossing the overbought boundary from above, the Stochastic signals a possible sell opportunity;

- Crossing the oversold boundary from below, the Stochastic signals a possible buy opportunity.

Crossovers of the indicator with its smoothened signal line, usually a 3-period moving average, may also detect deal opportunities:

- The indicator suggests going long when crossing the signal line from below;

- The indicator suggests going short when crossing the signal line from above.

Convergence/divergence patterns may indicate possible trend weakness:

- If the price climbs to a new high, but the indicator does not, that may be a sign of the uptrend weakness;

- If the price falls to a new low, but the indicator does not, that may be a sign of the downtrend weakness.

Stochastic Oscillator Trading Strategy

Stochastic system is based on the observation that in an uptrend closing prices tend to be near the upper end of the price range, and in a downtrend the closing prices tend to be near the lower end of the price range.

In the Stochastic strategy two lines - the %K line and the %D line – are used. The K line is faster and the D line is slower. These lines oscillate from 0 to 100 on the vertical scale. The major signal to consider is the divergence between the D line and the price of the underlying market. When the D line is over 80 and forms two declining peaks with prices moving higher, a bearish divergence occurs. When the D line is below 20 and forms two rising bottoms with prices moving lower, a bullish divergence takes place. Thus, the actual buy and sell signals are triggered when the K line crosses the D line. A sell signal is generated when the K line crosses below the D line from above the 80 level. Accordingly, a buy signal is generated when the K line crosses above the D line bellow the 20 level.

Stochastic Oscillator Formula (Calculation)

Stochastic = 100 x ((C – L)/(H – L));

Signal = average of the last three Stochastic values;

where:

C – latest close price;

L – the lowest price over a given period;

H – the highest price over a given period.

Williams Percent Range(WPR,%R)¶

Williams Percent Range (%R) is a technical indicator developed by Larry Williams to identify whether an asset is overbought or oversold and therefore to determine possible turning points. Unlike the Stochastic oscillator Williams Percent Range is a single line fluctuating on a reverse scale.

How to Use %R

The main goal of Williams Percent Range is to identify possible overbought and oversold areas, however the indicator should be considered within trend analysis:

- Generally if the indicator climbs above -20, the asset may be overbought;

- If the indicator drops below -80, the asset may be oversold.

Leaving extreme areas the indicator may suggest possible turning points:

- Crossing the overbought boundary from above, Williams Percent Range signals a possible sell opportunity;

- Crossing the oversold boundary from below, Williams Percent Range signals a possible buy opportunity.

Divergence patterns are rare, but may indicate possible trend weakness:

- If the price climbs to a new high, but the indicator does not, that may be a sign of the uptrend weakness;

- If the price falls to a new low, but the indicator does not, that may be a sign of the downtrend weakness.

Williams %R Trading Strategy

Williams %r indicator, as already mentioned, helps to determine the points when the market is oversold or overbought. The trading rules of %R strategy are simple: buying when the market is oversold (%R reaches -80% or lower) and selling when the market is overbought (%R reaches -20% or higher).

Williams %R Formula (Calculation)

R% = - ((H - C)/(H – L)) x 100;

where:

C – latest close price;

L – the lowest price over a given period;

H – the highest price over a given period.

Trend Indicators¶

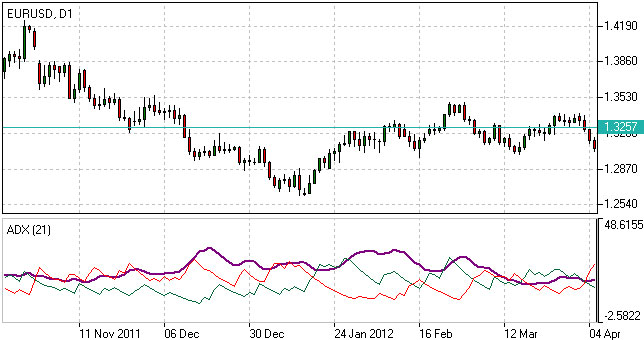

Average Directional Index(ADI)¶

Average Directional Index (ADX) is a technical indicator developed by Welles Wilder to estimate trend strength and determine probable further price movements by comparing the difference between two consecutive lows with the difference between the highs.

How to Use ADX Indicator

ADX is a complex indicator, which results from calculation of the Plus Directional Indicator (+DI – green line) and the Minus Directional Indicator (-DI – red line), but all of them may be used for trend analysis.

In general the indicator (bold line) move is believed to reflect current trend strength:

- Rising ADX (usually climbing above 25) suggests strengthening market trend – trend following indicators are becoming more useful;

- Falling ADX suggests the trend development is doubtful. ADX values below 20 may indicate neutral trend is present – oscillators are becoming more useful.

Use of complex ADX trading system may require additional confirmation signals:

- Normally if +DI (green line) climbs above -DI (red line), a buy signal is generated;

- Normally if -DI climbs above +DI, a sell signal is generated.

ADX Trading Strategy

ADX trading strategy aims to identify the strongest trends and distinguish between trending and non-trending conditions.

ADX reading above 25 indicates trend strength, while when ADX is below 25, this shows trend weakness. Breakouts, which are not difficult to spot, also help to identify whether ADX is strong enough for the price to trend or not. Thus, when ADX rises from below 25 to above 25, trend is considered strong enough to continue in the direction of the breakout.

It’s a common misperception that when ADX line starts falling this is a sign of trend reversal. Whereas, it only means that the trend strength is weakening. As long as ADX is above 25, it should be considered that a falling ADX line is simply less strong.

ADX Formula (Calculation)

ADX = MA [((+DI) – (-DI)) / ((+DI) + (-DI))] x 100;

where:

+DI – Plus Directional Indicator;

-DI – Minus Directional Indicator.

Moving Average(MA)¶

Moving Average is a technical analysis tool that shows average price over a given period of time, which is used to smoothen price fluctuations and therefore to determine trend direction and strength.

Depending of the method of averaging, distinguish between simple moving average (SMA), smoothed moving average (SMMA) and exponential moving average (EMA).

How to Use Moving Average

Generally moving average curves analysis includes the following principles:

- Direction of moving average curve reflects prevailing trend over a period;

- Low-period averaging may give more false signals, while large-period averaging tend to be lagging;

- To increase (decrease) sensitivity of the curve one should decrease (increase) the period of averaging;

- Average curves are more useful in trending environment.

Comparing moving average with price movements:

- A strong buy (sell) signal arise if price crosses from below (from above) its rising (falling) moving average curve;

- A weak buy (sell) signal arise if price crosses from below (from above) its falling (rising) moving average curve.

Comparing moving average curves of different periods:

- A rising (falling) lower-period curve crossing from below (above) another rising (falling) longer-period curve gives a strong buy (sell) signal;

- A rising (falling) lower-period curve crossing from below (above) another falling (rising) longer-period curve gives a weak buy (sell) signal.

Moving Average Trading Strategy

Moving average strategy is essentially a trend following means. Its objective is to signal the beginning of a new trend or a trend reversal. Herein, its main purpose is to track the progress of the trend and not to predict market action in the same sense that technical analysis attempts to do. By its nature, Moving Average is a follower; it follows the market telling that a new trend has begun or reversed only after the fact.

Moving Average Formula (Calculation)

SMA = Sum (Close (i), N) / N,

where:

Close (i) – current close price;

N – period of averaging.

EMA(t) = EMA(t-1) + (K x [Close(t) – EMA(t-1)]),

where:

t – current period;

K = 2 / (N + 1), N – period of averaging.

SMA¶

Generally, the term ''Moving Average'' refers to Simple Moving Average. The latter does not predict price direction; it is a lagging indicator and rather defines the current direction. It is an indicator that shows the average value of the instrument's price over a specified period of time.

Simple Moving Average Example

An SMA is calculated by adding the closing price of the instrument to the number of time periods and then dividing the total number by the number of time periods. The result will be the average price of the instrument over a certain time period. Thus, in order to calculate a 10-day SMA, it's necessary to add closing prices over a 10-day period and divide the total number by 10. As the term ''moving'' implies, prices move according to the point on the chart. This means that always a new calculation is needed that can correspond to the time period of the average used. Thus, you can recalculate a 10-day average by adding the new day and missing out the 10th day and so on.

Though simple moving average is used by most traders and analysts, it is criticized by two reasons. The first criticism is that only the time period covered by the average is taken into consideration. And secondly, the SMA gives equal weight to each day's price.

Nevertheless, Simple Moving Average has become a preferred method for tracking prices due to its simplicity and quick calculation. By the same simplicity early market analysts performed the market analysis without using complicated chart metrics that are widely applied today. They mainly relied on market prices as the main means of tracking trends and market direction. This process was boring but was confirmed to be profitable and reliable, and up till now it continues to be a popular technical analysis tool extensively used by most traders.

Moving Average of Oscillator(OsMA)¶

Moving Average of Oscillator (OsMA) is a technical analysis tool that reflects the difference between an oscillator (MACD) and its moving average (signal line).

How to Use OsMa Indicator

Extremum points:

- OsMA switching from falling to rising in extreme areas may be a sign of bullish reversal;

- OsMA switching from rising to falling may be a sign of bearish reversal.

Crossing zero axis:

- OsMA rising above zero (corresponds to MACD crossing from below its signal line) generates a buy signal;

- OsMA falling below zero (corresponds to MACD crossing from above its signal line) generates a sell signal.

Moving Average of Oscillator Formula (Calculation)

OsMA = MACD – Signal

Parabolic(SAR)¶

Parabolic is a trend following indicator developed by Welles Wilder and designed to confirm or reject trend direction, to determine trend end, correction or flat stages as well as to indicate possible exit points. The underlying principle of the indicator can be described as “stop and reverse” (SAR).

How to Use Parabolic SAR

When using the indicator we should take into consideration its positioning against the price chart as well as its acceleration factor which increases together with the trend. Despite being a popular tool of analysis, it has limitations and may give false signals in frequently changing market conditions.

The indicator may signal the following:

Trend confirmation

- If the indicator is plotted below the price graph, it stands for an uptrend;

- If the indicator is plotted above the price graph, it confirms a downtrend.

Exit points determination

- If the price drops below Parabolic line during an uptrend, there may be sense in closing long positions;

- If the price rises above Parabolic curve during a downtrend, there may be sense in closing short positions.

Signal significance is determined with the use of the acceleration factor. The acceleration factor increases each time the close price is higher than its previous value in an uptrend and lower in a downtrend. It is believed that the indicator is more reliable when the price’s and the indicator’s moves are parallel and less reliable when they converge.

Parabolic SAR Formula (Calculation)

P(t) = P(t-1) + AF x (EP(t-1) – P(t-1)),

where:

P(t) – current value of the indicator;

P(t-1) – value in the previous period;

AF – acceleration factor, generally rising from 0.02 to 0.2 with a step of 0.02;

EP(t-1) – extreme price in the previous period.

ZigZag¶

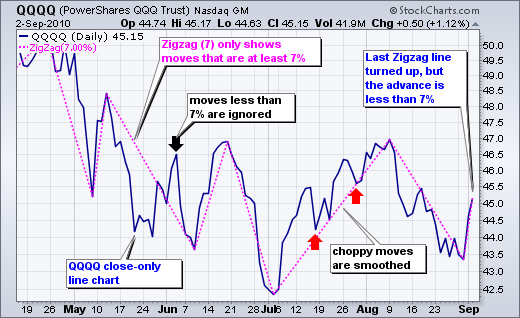

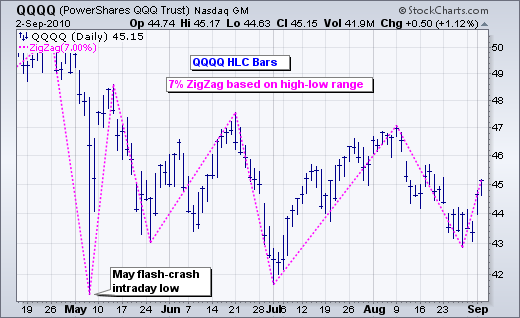

The ZigZag feature on SharpCharts is not an indicator per se, but rather a means to filter out smaller price movements. A ZigZag set at 10% would ignore all price movements less than 10%. Only price movements greater than 10% would be shown. Filtering out smaller movements gives chartists the ability to see the forest instead of just trees. It is important to remember that the ZigZag feature has no predictive power because it draws lines base on hindsight. Any predictive power will come from applications such as Elliott Wave, price pattern analysis or indicators. Chartists can also use the ZigZag with retracements feature to identify Fibonacci retracements and projections.

Calculation

The ZigZag is based on the chart “type.” Line and dot charts, which are based on the close, will show the ZigZag based on closing prices. High-Low-Close bars (HLC), Open-High-Low-Close (OHLC) bars and candlesticks, which show the period's high-low range, will show the ZigZag based on this high-low range. A ZigZag based on the high-low range is more likely to change course than a ZigZag based on the close because the high-low range will be much larger and produce bigger swings.

The parameters box allows chartists to set the sensitivity of the ZigZag feature. A ZigZag with 5 in the parameter box will filter out all movements less than 5%. A ZigZag(10) will filter out movements less than 10%. If a stock traded from a reaction low of 100 to a high of 109 (+9%), there would not be a line because the move was less than 10%. If the stock advanced from a low of 100 to a high of 110 (+10%), there would be a line from 100 to 110. If the stock continued on to 112, this line would extend to 112 (100 to 112). The ZigZag would not reverse until the stock declined 10% or more from its high. From a high of 112, a stock would have to decline 11.2 points (or to a low of 100.8) to warrant another line. The chart below shows a QQQQ line chart with a 7% ZigZag. The early June bounce was ignored because it was less than 7% (black arrow). The two pullbacks in July were ignored because they were much less than 7% (red arrows).

Be careful with the last ZigZag line. Astute chartists will notice that the last ZigZag line is up even though QQQQ advanced just 4.13% (43.36 to 45.15). This is just a temporary line because QQQQ has yet to reach the 7% change threshold. A move to 46.40 is needed for a gain of 7%, which would then warrant a permanent ZigZag line. Should QQQQ fail to reach the 7% threshold on this bounce and then decline below 43, this temporary line would disappear and the prior ZigZag line would continue from the early August high.

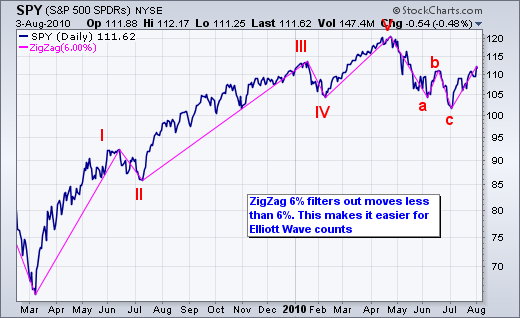

Elliott Wave Counts

The ZigZag feature can be used to filter out small moves and make Elliott Wave counts more straight-forward. The chart below shows the S&P 500 ETF with a 6% ZigZag to filter moves less than 6%. After a little trial and error, 6% was deemed the threshold of importance. An advance or decline greater than 6% was deemed significant enough to warrant a wave for an Elliott count. Keep in mind that this is just an example. The threshold and the wave count are subjective and dependent on individual preferences. Based on the 6% ZigZag, a complete cycle was identified from March 2009 until July 2010. A complete cycle consists of 8 waves, 5 up and 3 down.

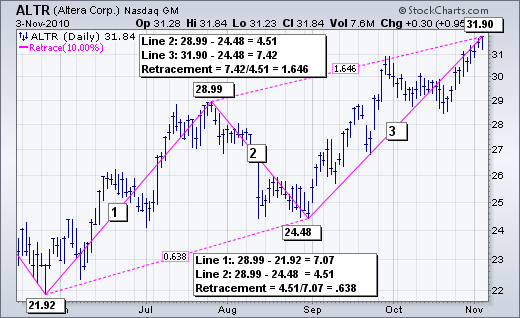

Retracements and Projections

Sharpcharts users can choose between the normal “ZigZag” and “ZigZag (Retrace.).” As shown in the examples above, the normal ZigZag shows lines that move at least a specific percentage. The ZigZag (Retrace.) connects the reaction highs and lows with labels that measure the prior move. The numbers on the dotted lines reflect the difference between the current Zigzag line and the ZigZag line immediately before it. For example, the chart below shows Altera (ALTR) with the 15% ZigZag (Retrace.) feature. Three ZigZag lines have been labeled (1, 2 and 3). The dotted line connecting the low of Line 1 with the low of Line 2 shows a box with 0.638. This means Line 2 is .638 (63.8%) of Line 1. A number below 1 means the line is shorter than the prior line. The dotted line connecting the high of Line 2 with the high of Line 3 shows a box with 1.646. This means Line 3 is 1.646 (164.6%) of Line 2. A number above 1 means the line is longer than the prior line.

As you may have guessed, seeing these lines as a percentage of the prior lines makes it possible to assess Fibonacci retracements Fibonacci projections. The August decline (Line 2) retraced around 61.8% of the June-July advance (Line 1). This is a classic Fibonacci retracement. The advance from early September to early November was 1.646 times the August decline. In this sense, the ZigZag (Retrace.) can be used to project the length of an advance. Again, 1.646 is close to the Fibonacci 1.618, which is the Golden Ratio used in many projection estimates. See our ChartSchool article for more on Fibonacci retracements.

Conclusions

The ZigZag and ZigZag (Retrace.) filter price action and do not have any predictive power. The ZigZag lines simply react when prices move a certain percentage. Chartists can apply an array of technical analysis tools to the ZigZag. Chartists can perform basic trend analysis by comparing reaction highs and lows. Chartists can also overlay the ZigZag feature to look for price patterns that might not be as visible on a normal bar or line chart. The ZigZag has a way of highlighting the important movements and ignoring the noise. When using the ZigZag feature, don't forget to measure the last line to determine if it is temporary or permanent. The last ZigZag line is temporary if the current price change is less than the ZigZag parameter. The last line is permanent when the price change is greater than or equal to the ZigZag parameter.

Volume Indicators¶

Accumulation/Distribution(AD)¶

Accumulation/Distribution is a volume-based technical analysis indicator designed to reflect cumulative inflows and outflows of money for an asset by comparing close prices with highs and lows and weighting the relation by trading volumes.

How to Use Accumulation/Distribution

The Accumulation/Distribution line is used for trend confirmation or possible turning points identification purposes.

Trend confirmation:

- An uptrend in prices is confirmed if A/D line is rising;

- A downtrend in prices is confirmed if A/D line is falling.

Divergence pattern analysis:

- Rising A/D line along with decreasing prices indicates the downtrend may be weakening to a bullish reversal;

- Falling A/D along with rising prices indicates the uptrend may be weakening to a bearish reversal.

Accumulation/Distribution Indicator Formula (Calculation)

A/D(t) = [((C – L) – (H – C)) / (H – L)] x Vol + A/D(t-1),

where:

A/D(t) – current Accumulation/Distribution value;

A/D(t-1) – previous Accumulation/Distribution value;

H – current high;

L – current low;

C – close price;

Vol – volume.

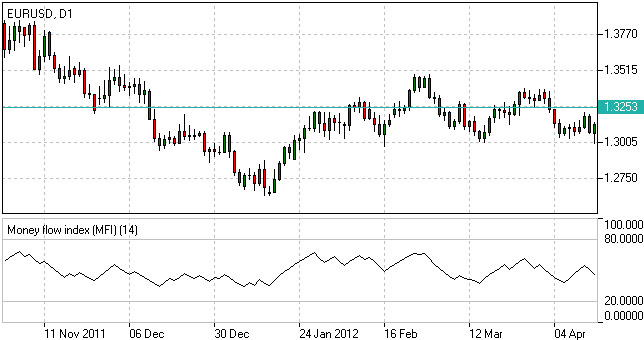

Money Flow Index(MFI)¶

Money Flow Index (MFI) is a technical indicator developed to estimate money inflow intensity into a certain asset by comparing price increases and decreases over a given period, but also taking into consideration trading volumes. How to Use Money Flow Index

The indicator can be used to identify whether an asset is overbought or oversold, as well as to determine possible turning points.

Analyzing extreme (overbought/oversold) areas:

- If MFI climbs above 80, the asset is generally considered to be overbought. A sell signal appears if MFI crosses the overbought area boundary from above;

- If MFI drops below 20, the asset is generally considered to be oversold. A buy signal appears if MFI crosses the oversold area boundary from below.

Divergence patterns analysis:

- Rising MFI along with decreasing prices indicates the downtrend may be weakening;

- Falling MFI along with rising prices indicates the uptrend may be weakening.

Money Flow Index Formula (Calculation)

The following steps are required to calculate the index:

1. TP = (H + L + C) / 3;

2. MF = TP*Vol;

3. MR = Sum(MF+) / Sum(MF-);

4. MFI = 100 – (100 / (1 + MR)),

where:

TP – typical price;

H – current high;

L – current low;

C – close price;

MF – money flow (positive (MF+) if current TP > previous TP, negative (MF-) otherwise);

Vol – volume;

MR – money ratio.

On-Balance Volume(OBV)¶

On-Balance Volume (OBV) is a cumulative volume-based tool intended to show the relation between the amount of deals and asset’s price movements.

How to Use On Balance Volume

The On-Balance Volume line is used for trend confirmation or possible turning points identification purposes.

Trend confirmation:

- An uptrend in prices is confirmed if the line is rising;

- A downtrend in prices is confirmed if the line is falling.

Divergence pattern analysis:

- Rising OBV line along with decreasing prices indicates the downtrend may be weakening to a bullish reversal;

- Falling OBV along with rising prices indicates the uptrend may be weakening to a bearish reversal.

On-Balance Volume Formula (Calculation)

OBV(t) = OBV(t-1) + Vol, if C(t) > C(t-1);

OBV(t) = OBV(t-1) – Vol, if C(t) < C(t-1);

OBV(t) = OBV(t-1), if C(t) = C(t-1),

where:

t – current period;

t-1 – previous period;

C – close price;

Vol – volume.

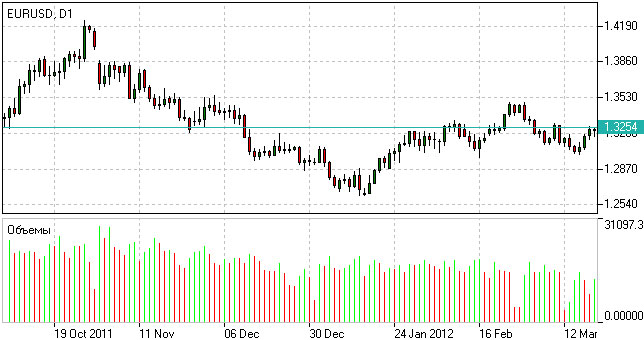

Volumes¶

Volume indicator is a technical analysis tool, which reflects trading activity of investors for a given time period.

How to Use Volume Indicator

Volume indicator is generally used together with price analysis to confirm trend strength or highlight its weakness and therefore identify possible upcoming reversals.

Trend confirmation:

- Rising trading volumes during an uptrend confirms bullish mood;

- Rising trading volumes during a downtrend confirms bearish mood.

Trend weakness:

- If volumes are falling while prices are increasing, that may be a sign of uptrend weakness, as demand for the asset may cease at higher prices.

Forex Volumes Calculation

Volume = total value/number of transactions during a given period.

5.2 自动交易基础¶

笔者编写了一些交易脚本,包括EA和script,可访问https://github.com/lofyer/mt4-scripts进行下载。

5.3 基本分析基础¶

央行测量啦、社会指标啦、等等啦啦啦